A long time ago, jewelry dealers came up with a marketing gimmick. The trick was designed to get people to buy engagement rings. Specifically, diamond engagement rings. The marketing ad was called the 'two-to-three' months' salary rule. Diamond engagement rings were portrayed to be the epitome of all gemstones. A diamond ring for your engagement is still a status symbol. The bigger the stone, the bigger the status. The copywriting was so good that people got convinced. It's pretty simple. You put away three months' worth of your salary, which becomes the amount you spend on a ring. For instance, save three grand if you earn a thousand dollars monthly. That should get you a decent ring. Think about it. It's a great way to save up and buy a ring. But it's full of limitations.

One's obvious. You get hypnotized. Who says you have to save for three months to buy a ring? It wouldn't kill you to save up for six months, a year, or even a bit longer. Saving up and paying cash is the least expensive way to buy an engagement ring. The alternatives are tricky and require professional advice for a licensed financial planner. The earlier you plan for the occasion, the earlier you set aside the funds. Does it have to be a diamond engagement ring because there're other viable alternatives in the market?

What if you have a great job or multiple income streams and a big check at the end of the month, say a million dollars? Are you going to spend 3 million on an engagement ring? Not that anybody would stop you if that's what you want. But if you have that kind of income potential, you would rather spend a reasonable amount on the ring and the upcoming wedding. Prioritize the essential investments first. You can visit your bank and open up a certificate of deposit or set up a trust fund for your kids. Spending 3 million dollars on a ring wouldn't make sense just because a rule convinced you. And if you do, it'll get you the 'status.' However, don't you think better personal financial management should come first?

The future is always uncertain. You have to think about the cost of living. Some money you're blowing on the engagement ring could go towards a solid retirement plan. Besides, people get engaged at different stages of life and in financial positions. Others are not salaried, so they move from paycheck to paycheck. The two-or-three month rule was an excellent promotional strategy while it lasted, but it wouldn't work for most people today. It has lost its practicality, so you need an informed budget — plan according to your financial capacity.

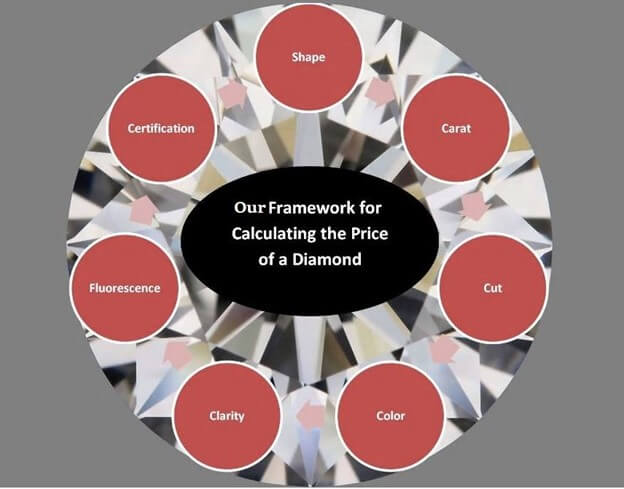

Make buying the engagement ring a smart purchase. Moreover, know that you should buy a unique engagement ring thoughtfully and not necessarily expensively. Remember, after the engagement, the marriage's equally important. The last thing you want to do is cause financial friction in your relationship. Plus, other milestone financial obligations await you: buying a house, a family car, and other substantial financial investments. Engagement ring budgets vary based on a couple of things; among them is the current market prices of different types of engagement rings. You'll also need money for stone verification and rating services when buying engagement rings.